Tax-aware investing means you can have your cake and eat it too. As I set out in the previous two articles, using a combination of long and short positions in your portfolio lets you pursue positive returns while lowering your tax bill. Below are two common situations where tax-aware investing can really make a difference.

The Big Sale

Suppose you are realizing a substantial gain, whether owing to the sale of your business or perhaps by diversifying a large amount of highly-appreciated stock you have accumulated over time (e.g. as a company executive).

As we know, it’s possible to use losses in your portfolio to offset your investing gains. But in the case of a substantial gain, how are you going to find a loss big enough while still coming out ahead overall? The answer is simple: you plan ahead.

Suppose you establish a long-short portfolio, going long a basket of stocks you think will do well and shorting another basket you think will underperform. Let’s call this Step 1. If you make the right choices, you will experience a net positive performance over time. However, in any given year at least some of the short positions will generate losses.

For example, suppose $1m invested generates a 10% or $100k net gain. This consists of $400k in unrealized gains and $300,000 in realized losses. The result would be a $300k net capital loss for the tax year and a deferral of the $400k gain.

Losses can be carried forward to future tax years. After five years with the strategy, you can accumulate net losses of over $1.5m. These losses could now offset a large gain of $1.5m when you sell your business or sell highly appreciated shares.

The earlier you start, the more sizeable tax shield you can build. Also, if you have larger dollars to invest or add leverage to the long/short strategy, net capital losses can be even greater.

Can you hear the sound of champagne corks popping at the IRS? That’s right – me neither.

Income Taxes Too?

As we also mentioned in the initial article, tax-aware investing can extend beyond your portfolio capital gains to what in tax terms is referred to as ‘ordinary income’ – e.g. business income or non-business income such as wages, interest, IRA/401k distributions, and more.

To illustrate, let’s go back to the example of the married doctor couple mentioned in the first article. Suppose that their combined wage income is $1m. Let’s also assume they have ownership in a medical practice that generates an additional $500k in business income via a K1.

How can your investment losses be used to offset income outside the portfolio? Doing so first requires Step 1 with net capital losses being realized as previously described. In addition, Step 2 of the tax-aware strategy must be added, bifurcating tax attributes into either business income (ordinary income) or capital gains.

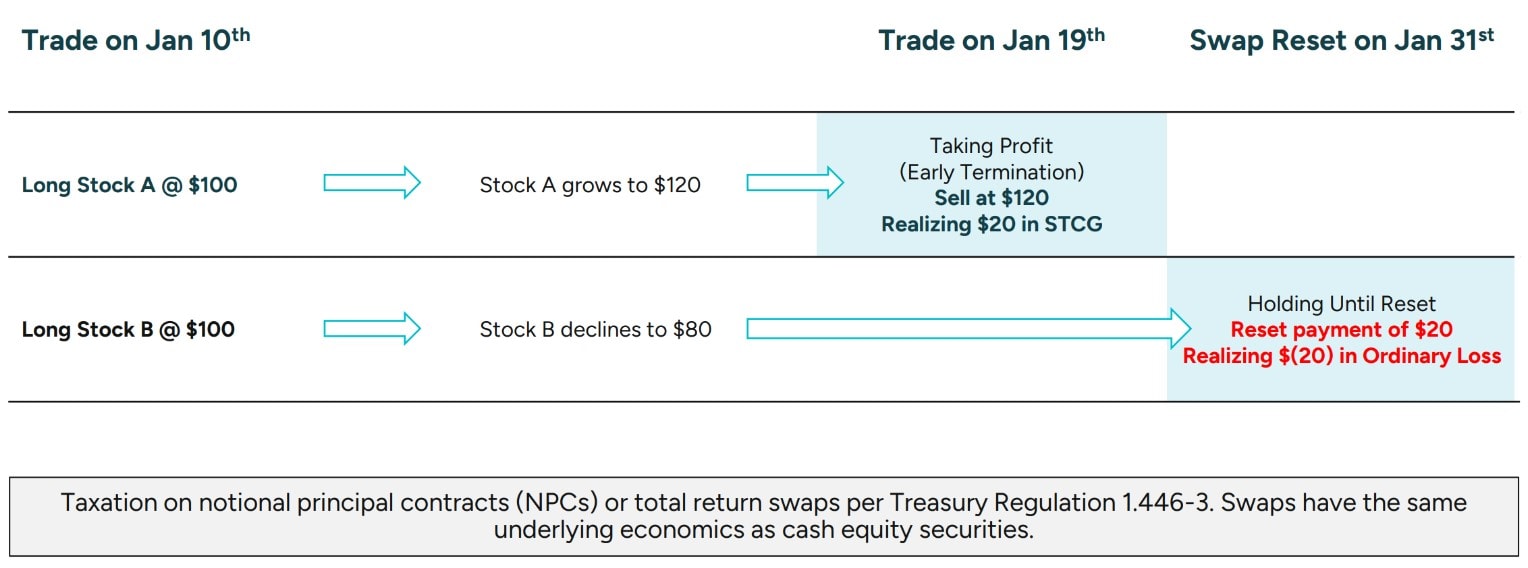

As is the case with tax law, the ins and outs are complex, especially here. Suppose in Step 2 you contribute cash into a partnership, becoming a limited partner (LP). The partnership elects to be taxed as a ‘trader’ rather than an ‘investor.’ And rather than using stocks as in Step 1, the general partner (GP) that runs the strategy utilizes swaps (or what the IRS technically defines as a notional principal contract). Swaps can be structured to have the same underlying economics as owning stocks outright but have different tax attributes.

For example, the GP could arrange for a swap with a large bank to replicate the performance of Apple stock over the next month. If the swap is held until the end of the month, the taxation results in business income. If the swap is terminated early, the taxation is a capital transaction – gain or loss.

Now suppose Step 2 generates an equal amount of short-term capital gains and business (ordinary) losses. Also assume Step 1 generated an equal amount of short-term capital losses to offset the gains realized in Step 2. The result is that you are left with zero net capital gains/losses and potentially substantial business losses. Business losses can then offset other business income, or they can offset non-business income up to a certain amount – $610k in 2024.

What does this mean for our couple? Well, if the couple’s Step 2 strategy resulted in business losses of $700k for 2024, here’s how it shakes out. They use the $700k as an offset first against their $500k of business income. Then the remaining $200k business loss as an offset to their wage income. Altogether, a $700k deduction saves $259k in federal taxes at their 37% rate.

These tax attributes coupled with the proper execution of the long-short, tax-aware investment strategy can provide you with the expectation to grow your wealth while realizing substantial tax benefits to boot. Not a bad day’s work!

Next Steps

In this short series on tax-aware investing, I have aimed to show you that it is a) possible and b) impactful. You’ll notice I’ve not mentioned anything about it being easy. This is because it requires a unique combination of deep expertise in investing, planning, and tax strategy along with the thoughtful coordination of each aligned to your specific situation. These are uncommon even in the professional space and may well be beyond the scope of what your current advisor(s) can handle.

The long and short of it is, it may be time for a 2nd opinion and explore how these tax-aware investing benefits may apply to you.

Kevin Kroskey, CFP®, MBA, is the Founder of True Wealth Design, which provides “Accounting, Tax & Wealth Solutions To Help You Plan Smarter and Live Better.” This article is for educational purposes only. The strategies referenced apply to Accredited Investors or Qualified Purchases per SEC regulations.

PS: If you’re ready to explore a relationship, use this link to schedule a free 15-minute call with one of our experienced and credentialed professionals.

Part 1: Tax-Aware Strategies for Successful Investors & High-Income Earners

Part 2: The Key to Tax-Aware Investing